What do you do when confronted with someone wanting to have you do something you don't want to do? In fewer words, how do you respond to oppositional, hostile force?

Of course, the force in question is probably a key to your response. Is someone trying to manipulate you into taking an unfair deal, or is someone trying to steal your car, or is someone threatening your life or way of life? Importantly your alternatives matter greatly as well. Can you delay, demur, deflect? Can you exit the situation with grace or perhaps with just some slight shame? Must you submit or resist perhaps with violence?

Let's focus on serious conflict where the stakes are relatively high if not exceptionally high. And in doing so we will think about situations from the standpoint of the victim or person under threat/attack. Therefore, this will be about degrees of losing where the best case outcome is the status quo.

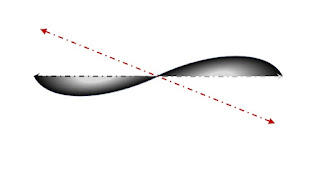

I see the options being somewhere between resistance to coercion and fighting for freedom. In a sense this is passive versus active or reactive versus proactive. Take the recent actions in Ukraine with Russia threatening and then attacking. As I write on February 26, 2022, Russia has invaded and is actively attacking various areas within Ukraine including the capital city Kyiv. It is very ugly, as war always is, and the initial news is likely sketchy and subject to revision.

That said, we can assume some basic facts to explore the implications. The Ukrainian government has not been friendly to Russia. This is a government the U.S. helped install and support going back to Obama administration. Long before that under the Clinton administration and then continuing into G.W. Bush's administration were numerous political moves and positioning to expand NATO including potentially adding Ukraine at some future date. Regardless of the likelihood of that officially happening, the support for Ukraine from NATO and its member countries as well as the outright enlargement of NATO to include former eastern-block nations in 1999, 2004, 2009, 2017, and 2020 have presented an expanding defensive/threatening position vis-a-via Russia.

This is not an apology piece for Russia or especially Putin. It does potentially give us some understanding for what Putin is doing and how he at least tries to defend it. The Russian government is a threat to its neighbors and NATO interests. But from the standpoint of Russia, the same can be said of NATO and actions the U.S. in particular has pursued. What is interesting to me is how the perspective of both sides can be used in this dimension analysis.

As Russia engages in violent acts harming and killing people, one could label it as "fighting for freedom"--just not in the noble sense we typically use that phraseology. They have turned from resistance to coercion as an option to actively striking out (I very deliberately don't say "striking back" since Russia has not been attacked).

Similarly the Ukrainian position has been resistance to coercion and especially the threat of future coercion by building an alliance with the West. Was this the only or best way to resist coercion? I would say probably not. Rather building ties economically and politically with Russia might have been a better strategy. In this I envision taking on an active Swiss-like neutrality while developing economic co-dependence through trade. NATO and the U.S. itself might have been much wiser to not expand NATO nor threaten to do so. Perhaps NATO should have deescalated following the fall of the Soviet Union in stages negotiating further and further withdrawal and peace leading potentially to eventually dissolving NATO altogether. This is my view, but this is not aimed at being an advocacy post nor a criticism. Rather I want to suggest that in light of these alternatives the geopolitical moves in Ukraine were in actuality fighting for freedom disguised as resistance.

Consider an analogy: A man and his family live and work in a dangerous community subject to high violent crime rates. While moving would be a great solution in theory, exit is not practicable for them. Whether they are correct or not, they feel trapped. Recently they have noticed that there are increasing incidences of violence in places they must frequent like the local grocery store and their workplace. So the man decides to start carrying a gun. Because he lives in a state that allows open carry, he can make visible his choice. [NB: This is not a post about the 2nd amendment, etc.]

Carrying a gun in this case could be thought of as resistance to coercion, but it also can be escalatory. The thugs in the neighborhood also feel trapped--they can't take their violent ways to another place. This is where they "work". So the thugs now consider their options. They could increase their own muscle/firepower. They could target others who look less capable of defending themselves. They might even consider tactics that amount to negotiating territory and room to operate like co-opting the shopkeeper or threatening more while accepting less.

But carrying a gun could also be fighting for freedom. The man is taking a stand and putting himself in harms way to the degree this act is escalatory or empowers him to take more risk. As an alternative or complement, he could advocate for more policing or security guards. If he didn't have an open-carry option, this advocacy might actually be more difficult if it puts him at greater risk when he carries a gun. Even if he can carry a concealed gun legally, the advocacy still pushes back on his own fighting for freedom option forcing him to be much more passive.

Sturdy doors with good locks, bars on windows, and burglar alarms are tools of coercion resistance for this family. But so too are guns, knives, big dogs, and baseball bats. The latter can easily become the tools of freedom fighting or outright aggression. The former might not have direct offensive capabilities, but they do invite suspicion as well as stronger opposition when opposition does come knocking. You're probably better off bringing no gun to a gun fight than bringing an unloaded gun and no ammo.

The point I'd like to make with the analogy is that it is hard to see where the lines are between what is resistance and what is fighting. Active resistance (e.g., carrying a gun) can be a threat, and that can be good, justifiable, and peacekeeping. It can also enable a fight where flight would otherwise be the better course of valor.

While it might be socially desirable to align with fighting for freedom, this positioning is antagonistic with unintended consequences. While it might feel noble to claim the mantle of resistance to coercion, this can be a provocative self-deception. Think how many so-called freedom fighters were either defending a brutal regime or whose actions lead to tyranny. Consider how often a resistance movement became offensive destruction. Once put into motion, forces opposing change or pursing change can be very hard to control.

George Washington fought for freedom, but so supposedly did Che Guevara. Washington's legacy was not a fight for complete freedom (see slavery), but I think his value alignment was much, much closer to virtuous than was Che's. It is hard to know where freedom fighters might lead us.

There is no left or right monopoly with either resistance or fighting. Easily I can think of resistance to coercion as being a conservative position as when something is threatening the status quo or tradition. I can also see how people could decide to resist being victimized by traditional norms--for example, racism, homophobia, etc. Fighting for freedom is on the other side of the axis where "Hell no! We won't go!" becomes "Come and take it." with no natural political connotations.

Neither motives nor outcomes can be determined based on which of these strategies is employed. Both methods can have a claim on the moral high ground as well as disastrous pitfalls if not evil ulterior motives. The non-aggression principle (NAP), a founding concept of libertarianism and classical liberal philosophy, implies strong constraints on both ends of this spectrum lest we become that which we seek to avoid.