- I want all my readers to forward links to this blog.

- To incentivize you please, inform everyone you send a link that they owe you $1.

- Also, inform them that they too are entitled to $1 for every link they send owed by the recipient of the link.

- It does not matter if the recipient has already received a link. In fact, that is an important part of building this network and realizing the fringe benefits.

Saturday, February 2, 2013

Some crazy scheme in order to make a profit

I want to boost traffic on this site. I know incentives work. Here is the plan:

Wednesday, January 30, 2013

I say shame, shame, shame, shame, shame, shame, shame, shame on you

A while back a Scott Sumner post titled American Shadows got me thinking about current practices, policies, and conditions in our society today that will horrify future generations. I have been planning on doing a post on it along with a sister post about current practices, policies, and conditions that will make future generations laugh, roll their eyes, and shake their heads. This week Sumner had another post along the same theme re-inspiring me. I have decided to combine the posts and will add to these lists as new items occur to me.

I grant that a case can be made for an item to be included on the opposing list or both lists. To the extent that this is a prediction (my primary goal), these are all arguable. To the extent that this is a personal commentary passing judgment on our society (a secondary goal), these are all again arguable, but for different reasons.

These are in no particular order, and I am concerned here with western society in general and the United States in particular. Considering the entire world would be a much, MUCH longer list.

Current practices, policies, and conditions in our society today that will horrify future generations:

I grant that a case can be made for an item to be included on the opposing list or both lists. To the extent that this is a prediction (my primary goal), these are all arguable. To the extent that this is a personal commentary passing judgment on our society (a secondary goal), these are all again arguable, but for different reasons.

These are in no particular order, and I am concerned here with western society in general and the United States in particular. Considering the entire world would be a much, MUCH longer list.

Current practices, policies, and conditions in our society today that will horrify future generations:

- Immigration restrictions

- Trade policies

- Drug laws and enforcement tactics

- Treatment of homosexuals and homosexuality

- Methods of the FDA, et al.

- Abortion as birth control

- Pain treatment and management intolerance and limitations

- Law and mores that have kept "amateur" athletes less than fully compensated (the case for this item being on this list is made when viewed in light of injuries and opportunity costs (two separate issues) that compound into life-long set backs). On this front there was a step toward justice today.

- Updated: Our tolerance for torture and other harsh treatments including prolonged, indefinite detention.

Current practices, policies, and conditions that will make future generations laugh, roll their eyes, and shake their heads:

- Government-monopolized postal delivery

- Government-run schooling

- Gambling restrictions

- Liquor laws

- Blue laws in general

- Tax policy (could easily warrant a spot on the first list)

- Regulations that aid existing businesses or other powerful interests

- Our views on many facets of science:

- Genetic alteration of plants and food

- Genetic testing and alterations in humans

- Cloning

- Stem cell research

- Our fears and understanding of climate change

- Updated: The silly ways in which we attempt to be good stewards of the environment such as obsessing about carbon footprints and shallow rationing devices to attain some mythical "sustainability" while ignoring the price system.

- Updated: Our fears of robots, machines, automation, AI, et al. This quote from a recent Econtalk with Kevin Kelly fits: "Your calculator is smarter than you right now in arithmetic. It doesn't freak you out just because it's a different kind of intelligence."

Additions to come I'm sure . . .

Tuesday, January 29, 2013

I'll take Intellectual Reconciliation for $1000, Alex.

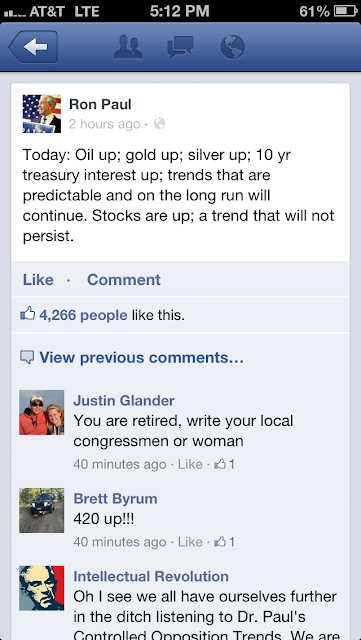

A reader sent me this screenshot of a Ron Paul Facebook post from today:

This is one of the few areas where Ron Paul and I part ways. I'm not sure relative to me if he is too pessimistic about the power of the market to overcome government failure or if I am too optimistic about the limits of government as a destructive force. Possibly some combination is the truth. We are both definitely believers in the market as a force of good and the government as a force of destruction (beyond extremely limited government). For the long-term, however, I would tend to agree with his take presuming no significant changes to the current trajectory of government growth and power. The unsustainability of the current path would imply downward corrections.

I am certainly reading between the lines on his post and perhaps making some errors when doing so.

This is one of the few areas where Ron Paul and I part ways. I'm not sure relative to me if he is too pessimistic about the power of the market to overcome government failure or if I am too optimistic about the limits of government as a destructive force. Possibly some combination is the truth. We are both definitely believers in the market as a force of good and the government as a force of destruction (beyond extremely limited government). For the long-term, however, I would tend to agree with his take presuming no significant changes to the current trajectory of government growth and power. The unsustainability of the current path would imply downward corrections.

I am certainly reading between the lines on his post and perhaps making some errors when doing so.

Sunday, January 27, 2013

Highly linkable

Bryan Caplan discusses Michael Huemer's new book, The Problem of Political Authority. I plan to read it soon.

Will the new drug Modafinil reduce wages if it succeeds in reducing the need for sleep? Garrett Jones has a good answer.

I'm a bit late on getting to this one, but it is tremendous. John Cochrane delivers a devastating critique of the New York Times' understanding of taxes--and perhaps this applies to progressives in general.

Alex Tabarrok shows how Big Cable is probably NOT cross subsidizing from non-sports fans to sports fans.

It's not easy being an economist. The public doesn't know what an economist can know/should know and what an economist can't know/shouldn't be expected to know.

Let's have a national garage sale this weekend and get rid of that pesky national debt. HT: MR.

Will the new drug Modafinil reduce wages if it succeeds in reducing the need for sleep? Garrett Jones has a good answer.

I'm a bit late on getting to this one, but it is tremendous. John Cochrane delivers a devastating critique of the New York Times' understanding of taxes--and perhaps this applies to progressives in general.

Alex Tabarrok shows how Big Cable is probably NOT cross subsidizing from non-sports fans to sports fans.

It's not easy being an economist. The public doesn't know what an economist can know/should know and what an economist can't know/shouldn't be expected to know.

Let's have a national garage sale this weekend and get rid of that pesky national debt. HT: MR.

Saturday, January 26, 2013

Is a cooperative, capitalistic society a de facto partial realization of a socialistic ideal?

Other titles considered for this post:

- What's one man's treasure, is another man's rental.

- Something borrowed . . .

I've written about sharing before. I've also mentioned 3-D printing, which seems to have the promise of shifting cost curves down by several orders of magnitude. But we should consider an opposing force that rather than increasing the quantity of tools (capital goods) and toys (consumption goods) increases the productivity of existing tools and toys--the "share economy".

Megan McArdle writing in the Daily Beast points to a Forbes piece that reveals just prolific sharing may become with new technological advances. The company profiled is AirBnB, and it serves as a good proxy for the many companies and changes this sharing economy could bring. Like any paradigm shift this substantial, technology alone won't get us there; culture changes probably will need to play a role as well. Regardless, the potential implications seem tremendous.

For example, also writing in Forbes, Chunka Mui has a series on how Google's driverless car technology could have trillion dollar impacts relatively soon--creative destruction writ larger than we've seen it in some time. If he is even partially correct, this will be a change to the auto industry (and many other industries as well) very comparable to what the advent of the auto industry did to buggy whips (and horse-drawn carriages, of course).

Now to relate this to the chosen title for this post. Part of the socialist ideal is a society where ownership does not preclude use or sharing. If my neighbor has a tool, I too can have a tool if I need one. Part of the problem for realizing the socialist ideal is that ownership is fairly essential for orderly allocation of resources. It is a practically necessary condition and definitely a sufficient condition for solving the Calculation Problem-assuming a price system evolves out of ownership. Capitalism, perhaps more appropriately free markets, has always been the best means of achieving the goals of more and more for everyone and continually optimizing resource allocation. Here again we see a major step toward realizing those goals.

The debate between socialism and capitalism is very much mostly not an argument about desirable ends but rather an argument about practical (largely) and principled (less so) means. Capitalism has always been saying, "I have some, and you can have some too." Socialism on the other hand has always been saying, "I ain't got nothing, but you can always have half!"

Thursday, January 24, 2013

If I Were a Rich Man . . .

Some estimates say that John D. Rockefeller was the richest American ever putting his wealth at the equivalent of ~$215 billion today*. There are a number of problems, though, with this simple process of taking a historic price and adjusting it forward by the inflation rate. Extrapolating a prior figure for inflation makes the extrapolation sensitive to the quality of the inflation estimate. That sensitivity grows and compounds as the time span grows. Additionally, other factors become very important in long spans while they are non-factors in small spans. Quality is one of these factors, and it matters a lot. This post will have a lot of lessons in how magnitude matters.

I’ve been thinking about this post for a while since seeing a History Channel show about the wealthiest Americans in history. In yesterday's WSJ Don Boudreaux and Mark Perry have a great article on The Myth of Middle Class Stagnation, which inspired me to finalize this post. This is a must read piece that I can’t recommend enough. In it they give several examples of how problematic it is to simply take a historical price like average income and bring it up to the current through inflation adjustment for comparison to a similar figure today.

I would like to challenge the idea that John D. Rockefeller was the richest American ever. To do so I pose a question: Would I rather live today as I am, an upper-middle class father of three, or as Rockefeller in his day? Let’s think about this because it isn’t as easy as comparing my modest net worth (MUCH less than a small fraction of $1 billion) to his estimated at $215 billion today.

The most costly event in life is death. Let’s start with that. Life expectancy in the United States in the 1920s was about 55. At my birth it was about 72. Today it is about 78.

Perhaps the next most costly event for many of us is the potential of losing a child. Actually losing a child is the horrific realization of that cost. So let’s next look at infant and child mortality. For the U.S. in the 1920s & 30s both rates of death were about 6-8% (infant mortality covers children who die before one year of age; in this case child mortality covers children who die between age one and four inclusively). Today those mortality figures are about .6% for infants and about .1% for children aged 1-4. Those are remarkable reductions that are hard for us in this era to appreciate.

Another very costly event for a husband is maternal mortality (a mother’s death during childbirth). Here again we see stunning improvement. The rate was about .75% in 1920s & 30s. Today it is about .01% -- an improvement factor of 75 times.

Simply put when compared to today, living was more difficult and less likely in the early part of the 20th century. All the kings horses and all the kings men could hardly nudge any improvement out of that harsh health reality. We may already have our answer, but let’s go on for good measure.

Let’s think about what I can do today as compared to what the wealthiest man of that era, Rockefeller, could do then including some of the inconveniences and limitations that he faced that I do not. Specifically consider:

- People I can communicate with. I can reach out to my family and friends virtually any time of day no matter where I am or where they are. I can connect and correspond with people I have never met but with whom I share some common interest.

- Places I can go. I can travel at home and abroad generally more easily, more quickly, and in more ways. In fact, I can go places inaccessible even to him in his day. Even going to work, the car I ride in is better from seat warmers to safety.

- Conveniences I can expect at the places I can go. When I arrive at my destination, be it my office or a foreign tropical beach, I don't have to plan ahead nearly as much or spend nearly the resources to have many comforts and options to make my experience there quite enjoyable.

- Food I can eat. My food options dwarf his. I eat in greater confidence about the safety and freshness while I enjoy cheap, abundant, and extremely various food and drink much of which is of a quality he would envy.

- Entertainment I can enjoy. Music is incredibly better for me from the quality to the genre variety to accessibility. He could never see a television show or anything reasonably resembling a modern movie. His book options were quite limited relative to mine not to mention periodicals, research papers, blogs, and the like. I can see more theater in a few weeks than he could enjoy in years. Sports are other worldly today compared to what he could take in.

I could go on and on from how I can engage in financial markets in ways he couldn't dream to how I can know things about the universe confusing and unknown in his day to how I can dress more comfortably than him to how . . . . In summary I can do most of what he could do even with his vast wealth, and my options tend to be deeper and richer. I take back what I said earlier--this is as easy as comparing my wealth to his. Mine is higher.

*To reach this figure I took the NY Times estimate from 2007 and similarly increased it by the recent CPI inflation rate bringing it up to 2013.

PS. I owe Billy Ray $1. He bet me that I couldn't get rich and put Rockefeller in the poor house at the same time.

Sunday, January 20, 2013

The alpha dog don't hunt (maybe)

As a strong proponent of the semi-strong version of the Efficient Market Hypothesis (EMH), I have a bone to pick with the idea of alpha generation. First some terms explained.

Money managers such as mutual fund managers and hedge fund managers operate under the following premise: The attempt to grow investors' money over time. Some managers attempt to outperform the market (active managers) while others just attempt to replicate or stay with the market (passive managers). For this discussion we are only concerned with the investments of active managers. Whether successful or not (and success is a complicated determination as we will see), the investments will have some kind of results. There are two components of those results, alpha and beta.

Answering the last part first, beta is the component of a money manager's results (performance) that is attributable to or describable by the underlying market's results. That is to say someone who simply invests in the stock market will have results just from being invested in the stock market--regardless of the individual decisions that investor makes. A manager or investor who exactly mimicked the results* of the stock market would have a stock market beta equal to 1. One who exactly doubled the stock market's results* would have a beta equal to 2. Keep in mind that these figures apply up and down such that a portfolio with a beta of 2 would expect to have twice the up or down results of the underlying market. Comparing a manager with a beta of 1 to a manager with a beta of 2, we could say that the manger with beta equals 2 is expected to be twice as risky relative to the other manager considering the same underlying market for both.

Alpha on the other hand is the component of a money manager's results (performance) that is in excess or deficiency of the underlying market's results given the risk the manager took on. That is to say someone who simply invests in the stock market will have results just from the individual decisions that investor makes--regardless of the results from just being invested in the stock market. A manager or investor who exactly mimicked the results of the stock market would have a stock market alpha equal to 0% at any given level of beta.

The problems of moving from these theoretical constructs to the real world begin with the fact that if the market is really, really good at identifying, processing, and applying information (that is to say the market is highly efficient), then alpha shouldn't be possible (market participants shouldn't be able to out think the market). Our problems continue once we realize that it is very difficult to look at a money manager's results and separate out alpha and beta. The two get quite confoundedly interwoven for a number of reasons.

For one, when do we stop defining down the proper market comparison (benchmark) for a manager? Suppose he purchased 499 of the 500 stocks in the S&P 500 index in proportion to their weight in that index less the left out stock. Seems reasonable that the S&P 500 would be the proper benchmark. But the stock that gets excluded will make a big difference in how representative the S&P 500 is for his performance. Excluding Apple (currently ~4% of the index) versus excluding AutoNation (currently ~.01% of the index or 1/400 the value of Apple in the index) would have a significantly different effect. Suppose another manager purchased the same 499 stocks as the first but in quite different proportions. Suppose another only purchased 10 of the stocks. Describing all of these managers or any of them as compared to the S&P 500 might not be a very meaningful description.

Another reason alpha and beta are difficult to separate is that manager process and performance is not always very transparent. This makes finding suitable benchmarks more difficult. We could go on, but the foundation of the problem is already well established. A manager's alpha might just be the beta of a better defined benchmark.

So what to make of the elusive search for alpha? My thought is that the only true alpha is good beta management--perhaps "meta beta"would be the clever term for it. The goal then for a money manager is to achieve a beta appropriate for the investor and opportunistic when and if possible. A beta of .5 would be great in relative down markets but would have an obvious cost of underperformance generally. A beta of 2.5 would be great most of the time but would have the extreme risk of permanently impairing capital some of the time. Opportunistic beta management is dangerously close to market timing, which almost certainly is a fools errand. Yet there may be some ability to capture gains once we consider the position of the individual investor we are attempting to match up with an appropriate beta (e.g., relatively high beta for an investor with no withdrawal needs, a high capital base, a long time horizon, and otherwise high willingness and ability to take on risk).

I look at this, my understanding of and belief (or disbelief) in alpha, as a work in process. I have to reconcile any degree of belief in alpha with any degree of belief in efficient markets. Starting with my assumptions and belief in efficient markets does have a flavor of receiving the answers in advance of asking the questions, but I'll try to keep an open mind. I'll keep thinking . . .

*Mimicking results, doubling results, etc. with regard to beta means both the end result (return) and the path to get there (volatility).

Money managers such as mutual fund managers and hedge fund managers operate under the following premise: The attempt to grow investors' money over time. Some managers attempt to outperform the market (active managers) while others just attempt to replicate or stay with the market (passive managers). For this discussion we are only concerned with the investments of active managers. Whether successful or not (and success is a complicated determination as we will see), the investments will have some kind of results. There are two components of those results, alpha and beta.

Answering the last part first, beta is the component of a money manager's results (performance) that is attributable to or describable by the underlying market's results. That is to say someone who simply invests in the stock market will have results just from being invested in the stock market--regardless of the individual decisions that investor makes. A manager or investor who exactly mimicked the results* of the stock market would have a stock market beta equal to 1. One who exactly doubled the stock market's results* would have a beta equal to 2. Keep in mind that these figures apply up and down such that a portfolio with a beta of 2 would expect to have twice the up or down results of the underlying market. Comparing a manager with a beta of 1 to a manager with a beta of 2, we could say that the manger with beta equals 2 is expected to be twice as risky relative to the other manager considering the same underlying market for both.

Alpha on the other hand is the component of a money manager's results (performance) that is in excess or deficiency of the underlying market's results given the risk the manager took on. That is to say someone who simply invests in the stock market will have results just from the individual decisions that investor makes--regardless of the results from just being invested in the stock market. A manager or investor who exactly mimicked the results of the stock market would have a stock market alpha equal to 0% at any given level of beta.

The problems of moving from these theoretical constructs to the real world begin with the fact that if the market is really, really good at identifying, processing, and applying information (that is to say the market is highly efficient), then alpha shouldn't be possible (market participants shouldn't be able to out think the market). Our problems continue once we realize that it is very difficult to look at a money manager's results and separate out alpha and beta. The two get quite confoundedly interwoven for a number of reasons.

For one, when do we stop defining down the proper market comparison (benchmark) for a manager? Suppose he purchased 499 of the 500 stocks in the S&P 500 index in proportion to their weight in that index less the left out stock. Seems reasonable that the S&P 500 would be the proper benchmark. But the stock that gets excluded will make a big difference in how representative the S&P 500 is for his performance. Excluding Apple (currently ~4% of the index) versus excluding AutoNation (currently ~.01% of the index or 1/400 the value of Apple in the index) would have a significantly different effect. Suppose another manager purchased the same 499 stocks as the first but in quite different proportions. Suppose another only purchased 10 of the stocks. Describing all of these managers or any of them as compared to the S&P 500 might not be a very meaningful description.

Another reason alpha and beta are difficult to separate is that manager process and performance is not always very transparent. This makes finding suitable benchmarks more difficult. We could go on, but the foundation of the problem is already well established. A manager's alpha might just be the beta of a better defined benchmark.

So what to make of the elusive search for alpha? My thought is that the only true alpha is good beta management--perhaps "meta beta"would be the clever term for it. The goal then for a money manager is to achieve a beta appropriate for the investor and opportunistic when and if possible. A beta of .5 would be great in relative down markets but would have an obvious cost of underperformance generally. A beta of 2.5 would be great most of the time but would have the extreme risk of permanently impairing capital some of the time. Opportunistic beta management is dangerously close to market timing, which almost certainly is a fools errand. Yet there may be some ability to capture gains once we consider the position of the individual investor we are attempting to match up with an appropriate beta (e.g., relatively high beta for an investor with no withdrawal needs, a high capital base, a long time horizon, and otherwise high willingness and ability to take on risk).

I look at this, my understanding of and belief (or disbelief) in alpha, as a work in process. I have to reconcile any degree of belief in alpha with any degree of belief in efficient markets. Starting with my assumptions and belief in efficient markets does have a flavor of receiving the answers in advance of asking the questions, but I'll try to keep an open mind. I'll keep thinking . . .

*Mimicking results, doubling results, etc. with regard to beta means both the end result (return) and the path to get there (volatility).

Subscribe to:

Posts (Atom)